Experiments on Cumulative Destruction

Two approaches to bring bitcoin-days-destroyed into the price domain

Okay, so this article is now well overdue given the recent price action. BTC never rests! The last few months have been very productive in terms of discovering new valuation metrics based on on-chain analytics. The recent proposals using coindays destroyed by Tamas Blummer and the team at Adamant Capital have put this essential metric once again on the map. We thought we’d give it a go at coming up with a way to best translate the concept of destruction into a precise price level for market analysis.

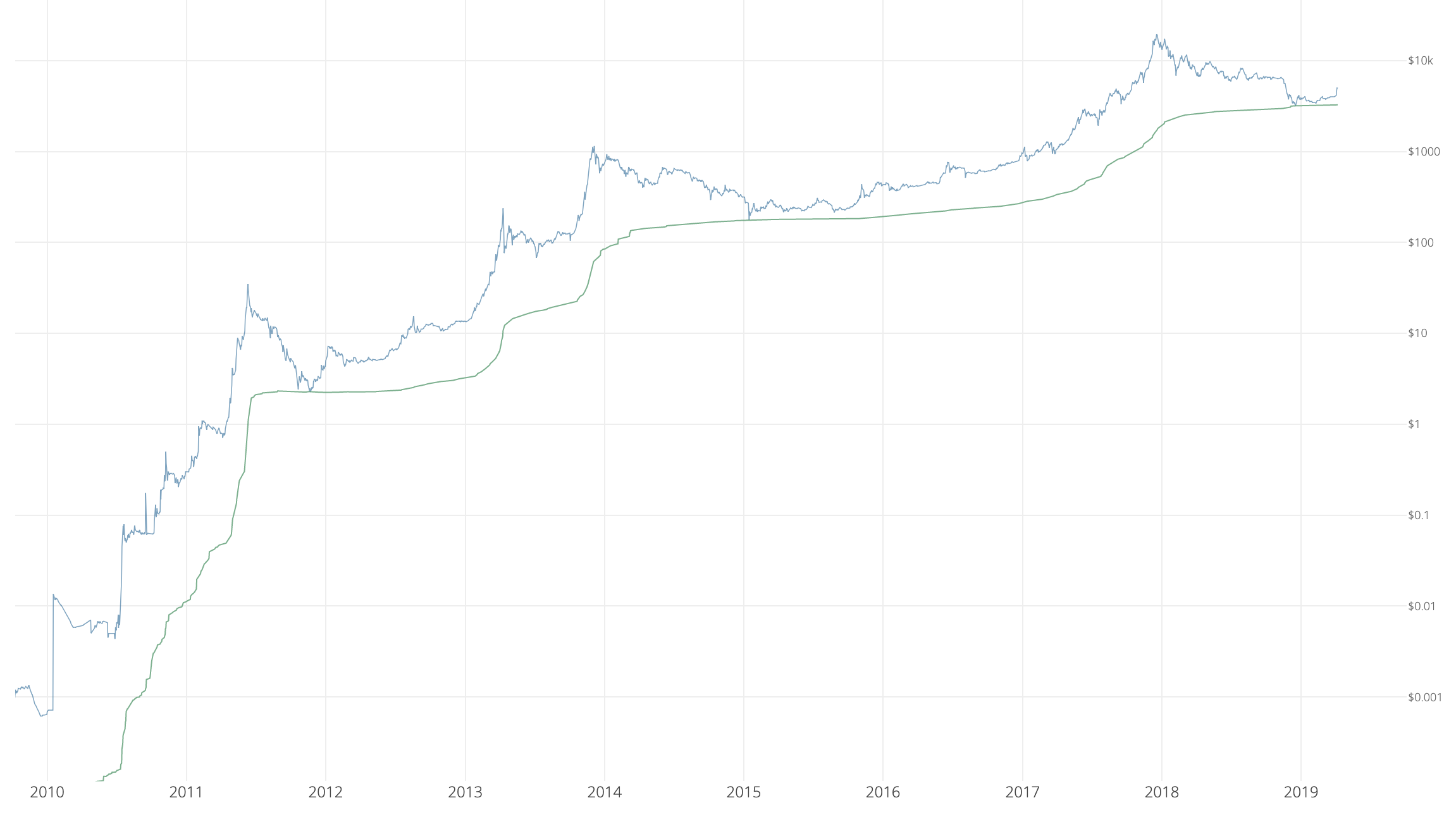

Experiment A: Cumulative Value-days Destroyed (CVDD) by Willy Woo

When coins move from one investor to another, the transaction carries both a USD value and also destroys a time value relating to how long the original investor held their coins. CVDD tracks the cumulative sum of this value-time destruction as coins move from old hands into new hands as a ratio to the market age. It is calculated with the following formula:

`CVDD_(USD)=(sum (bb"coin days destroyed" * price) )/ (days * 6000000`Note that 6 million is used in calibrating the chart. This number is arbitrary and would be different had we used hours or blocks as unit for the age of the market.

CVDD has hit the historical Bitcoin price bottoms with remarkable accuracy.

Unlike Delta Cap, CVDD tends to consistently climb in value - this becomes useful to frame an increasing lower bound for a market bottom during bear seasons when the market price is falling.

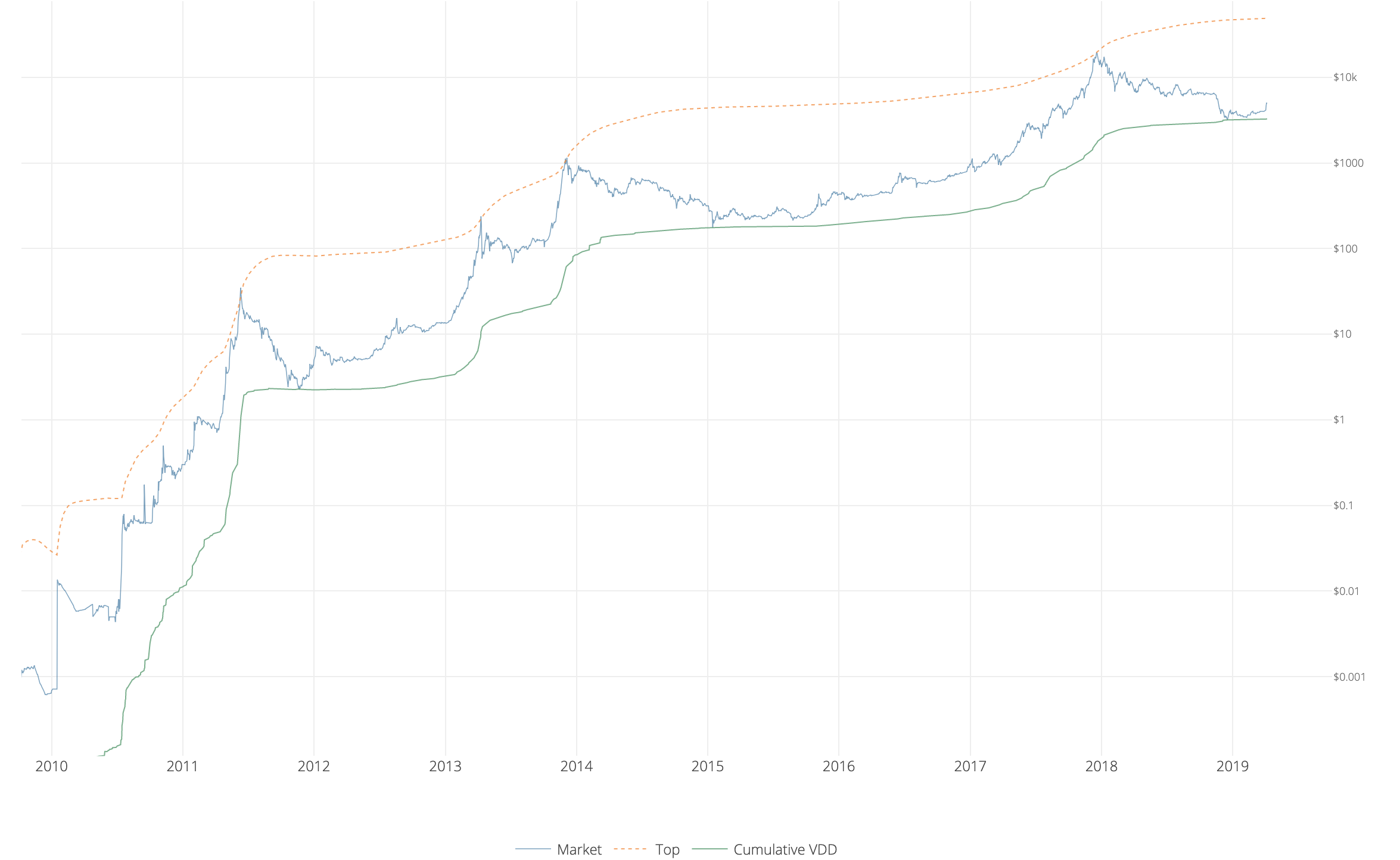

When used in conjunction with the Top Price model, CVDD and Top Price provides upper and lower bands for price action.

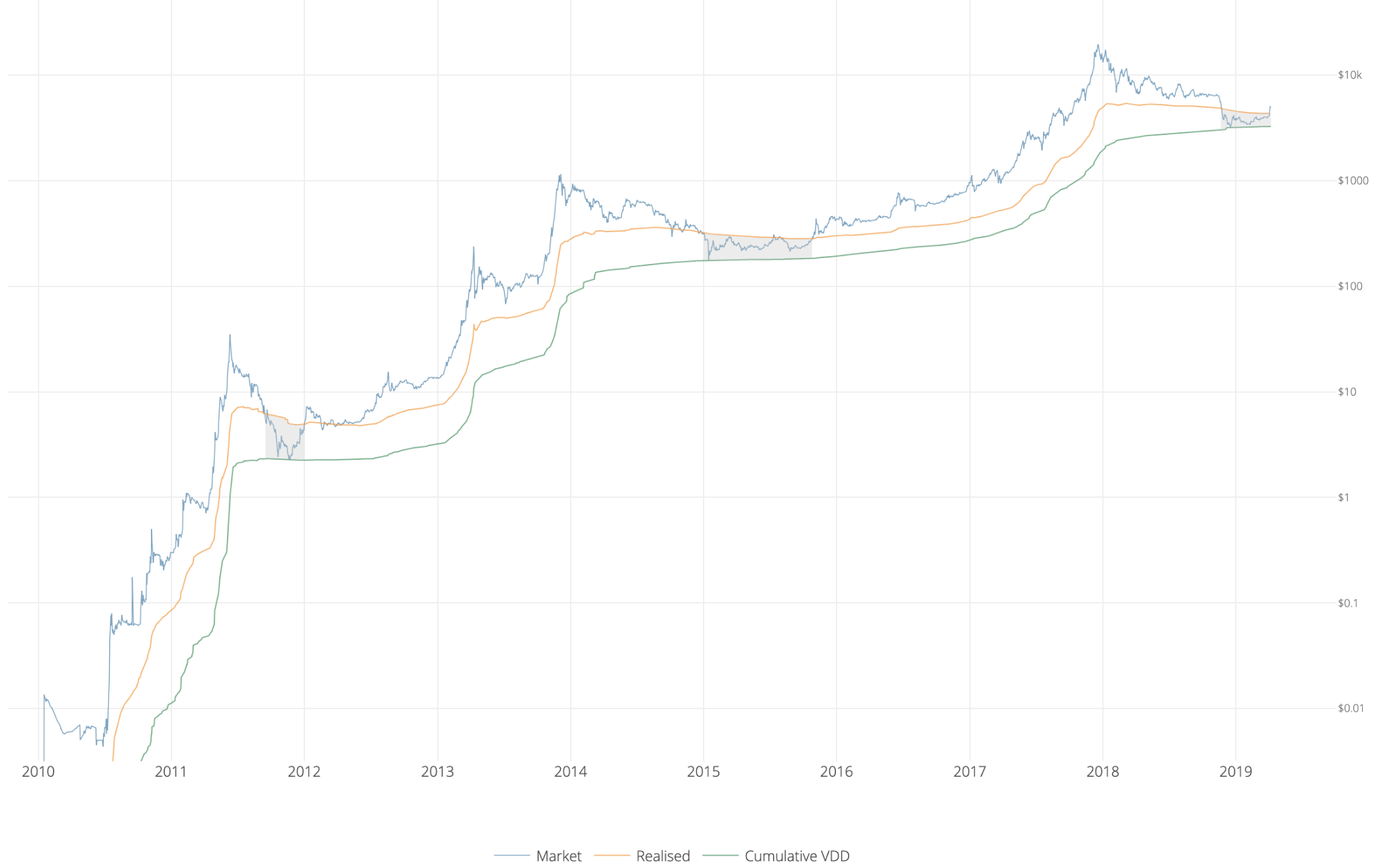

When used in conjunction with CoinMetric's Realised Price, CVDD can help visualization of Bitcoin's accumulation bottoms.

Both CVDD and Realised Price have remarkable resemblances in shape, its no coincidence that they both use investor HODL time in their calculation.

It is important to note that both CVDD and Top Price are interesting curiosities, and are not guaranteed to work in future cycles.

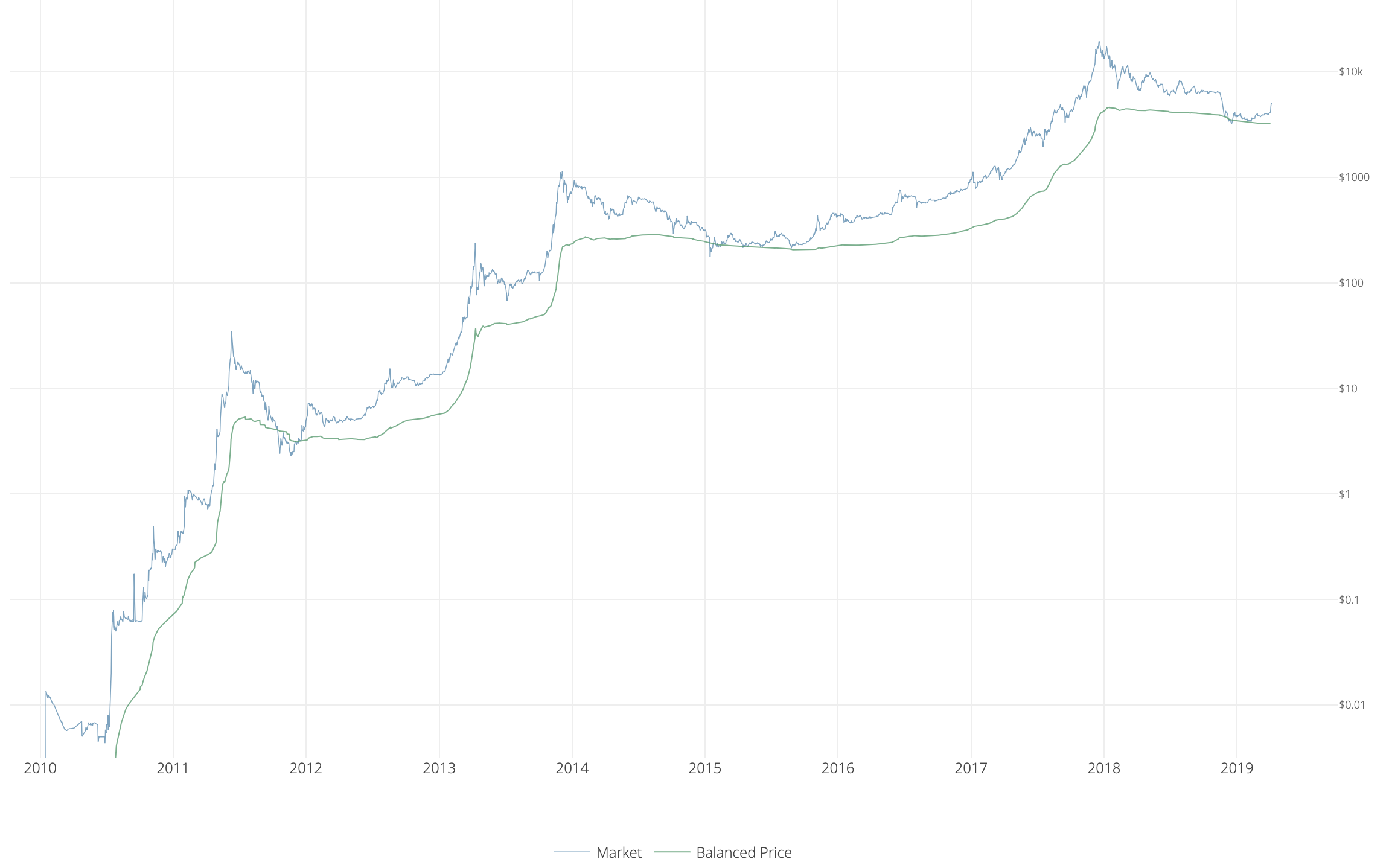

Experiment B: Transferred Price and Balanced Price by David Puell

Instead of using a 6-million figure, transferred price uses supply to bring destruction into the price domain:

`bb"TransferredPrice"_(USD)=(sum(bb"coindays destroyed" * price)) / (days * bb"supply")`Looking at this as a life-to-date moving average of spending behavior (again, old hands selling into new hands), it can be assumed that when subtracted from realized price (the average paid for all coins in the market), a “fair” valuation measure emerges. Balanced price denotes the level at which, during bear markets, a full detox has been achieved — market price matching what was paid minus what was spent.

`bb"BalancedPrice"_(USD)=bb"RealisedPrice"_(USD)-bb"TransferredPrice"_(USD)`

It goes without saying that this evokes Delta Price in both calculation and visualization. We believe that Delta Price serves as a technical analysis proxy of Balanced Price. The former seems to be agile enough to catch exact bottoms — the “wicks” — while the latter catches the full accumulation level prior to the bull run, also defining the brief moment when price remains below it as “capitulation.”

More iterations on coindays destroyed to follow. Stay tuned…

- This article was co-authored with David Puell, Head of Research at Adaptive Capital.

- A live chart of these metrics is available at Woobull Charts