Estimating return potential for altcoins and Bitcoin

I personally think very few people grasp how to gauge the long term return potential of Bitcoin vs altcoins. I often hear people say that Bitcoin is no longer cheap and that altcoins have more return potential being in their earlier stages, while they chase returns similar to Bitcoin’s ungodly growth during its drug-induced SilkRoad euphoric climb to notoriety.

In this article I’m going to apply some actual theory in order to get solid numerically based estimates on what the limits on returns are for Bitcoin and altcoins. To do this, I’ll be using The Quantity Theory of Money. In essence this is a pretty obvious equation that economists like to use to describe economies.

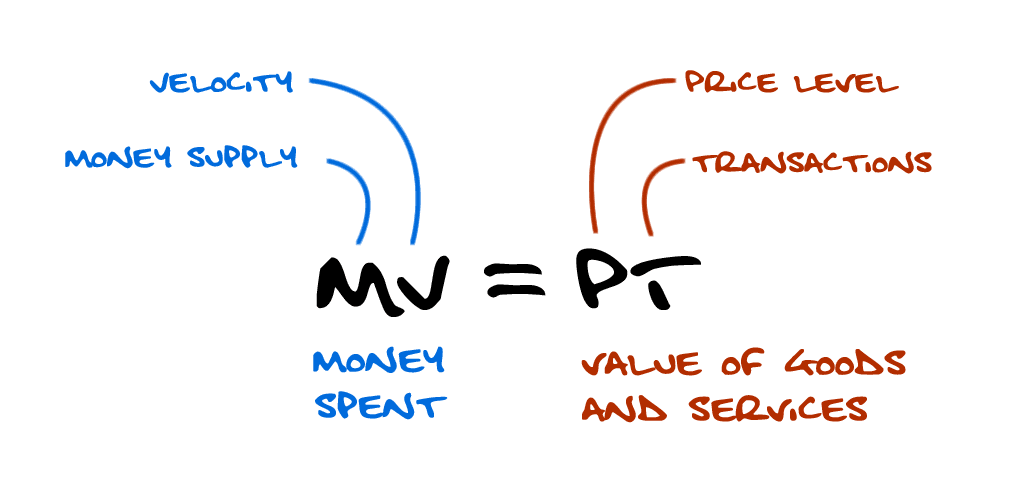

The Quantity Theory of Money

In plain english, this theory says that within an economy, the money that is spent must equal all the goods and services sold. This can be put down into an equation like this:

On the left side we have the money spent:

- M – this is the monetary supply

- V – this is the velocity of money, or how many times the money supply is spent during the measured time period

On the right we simply the value of goods and services:

- PT – price level multiplied by the transactions

Okay, this is straight forward… Onwards, let’s run some numbers…

Let’s value the size of the Bitcoin economy

To value the Bitcoin economy, we’ll make some assumptions about our encompassed economy. They will be extreme assumptions as we are after the maximum value for return:

- Bitcoin takes over all online retail sales by 2020 ($4.06t) [1]

- Bitcoin takes over all retail sales by 2020 ($27.2t) [1]

- Bitcoin takes over all GDP by 2020 ($93.6t) [2]

[1] – source: Emarketer.com

[2] – source: Wikipedia

In order to calculate results, we’ll need some details about the left side of the equation, the money supply and the velocity:

- Bitcoins in circulation by the end of 2020, we already know with great certainty will be 18.5M

- Bitcoin velocity? Since Bitcoin is similar to a savings account, I’ll use US M2 velocity which represents cash and savings/cheque accounts. It varies, but historically has been around 1.7 quarterly, so 6.8 annually.

- To calculate growth potential I’ve used today’s price of $740USD per BTC.

Plugging this into the equation in our 3 scenarios gives these results:

| **Market size** | **Money supply (max market cap)** M = PT/V | **Maximum price per coin** | **Potential Growth** | |

| **All online retail sales, 2020** | $4.06t | $597b | $32,300 | 44x |

| **All retail sales, 2020** | $27.2t | $4.0t | $216,000 | 292x |

| **All GDP, 2020** | $93.6t | $13.8t | $746,000 | 1010x |

Let’s value the size of the Safe Network economy

Okay now that we’ve done Bitcoin let’s compare to an app-coin economy. For this example I’ll pick MAID. The MAID token is linked to the Safe Network which aims to replace cloud computing and storage services. Additionally it aims to use the token to run a SaaS economy within its decentralised network. When the network goes live, MAID tokens will be converted to Safecoins and used as the token of payment on this network. Again, I’ll make some wild assumptions to estimate the absolute maximum for this economy:

- The Safe Network gobbles up the entire cloud computing sector by 2020

- Total market size of public cloud services reaches $423b in 2020. Gartner estimates this as $204b in 2016, I’ve assumed a generous compounded growth of 20% per annum.

- For the velocity of Safecoins, I’m going to assume a similar value as M1V, or US velocity of hard cash which is around 6 quarterly or 24 annually, i.e. each token gets circulated 24x each year.

- One may make an argument that an app-token also represents a store of value and there will be holders of the currency for savings and speculation. So in this scenario M2 velocity, like I used for Bitcoin, may be more appropriate. I shall use M2 velocity as an alternative scenario.

- To calculate growth potential I’ve used today’s price of $0.07 USD per MAID.

Here’s the results:

| **Market size** | **Money supply (max market cap)** M = PT/V | **Max price per coin** | **Potential Growth** | |

| **All public cloud services (2020) using US M1 velocity** | $403b | $16.8b | $3.92 | 56x |

| **All public cloud services (2020) using US M2 velocity** | $403b | $59.3b | $13.80 | 197x |

Some notes about the assumptions

I made some large assumptions in this analysis:

- I’ve used 2020 as a date in the future to run these estimates. Obviously it’s overly optimistic for adoption, but I wanted to use market size figures that are within our realms of predictability. If the markets grow roughly at the same rate over a longer term the results when comparing altcoins to Bitcoin will be similar.

- We really don’t know what the velocity of money will be in these economies, so I used a best guess from US monetary velocities. If they deviate from my assumptions the results may vary substantially.

- In my last estimate of Bitcoin expressed in terms of World GDP, I used a simplistic calculation assuming all industries will be paid for in bitcoin. In a scenario where crypto currency takes over, you should deduct all market segments using altcoin currencies as payment to arrive at the remainder which will be the M2 money supply for Bitcoin.

- Bitcoin in real life likely has a much lower velocity and a much higher return that this analysis suggests due to the hoarding nature of its environment. In a world of 2 competing currencies, say Bitcoin and fiat, people will spend the weaker one, the one that devalues, and hold the stronger one. They’ll spend fiat and hold Bitcoin, reducing its velocity drastically.

Conclusions

It should be obvious by now that the growth left in a token’s economy is a combination of the ultimate size the market, and how nascent the technology is.

In the case of Bitcoin (or whatever coin that will win “general money” dominance), we are looking at huge market sizes, ultimately approaching all of world GDP if it becomes a reserve currency. For an app-token, the market size will be much smaller, but this is offset by the earlier stage of the growth curve these technologies are in, thus the room for growth is still pretty good.

From an investor standpoint Bitcoin looks really attractive. Bitcoin promises similar or greater growth potential to altcoins without the same risk. In the race for general value transfer, Bitcoin has no real competitors of comparable scale and network effects. Meanwhile all app-coins are still battling it out in their early stages for market share.