Estimated price impact from a Bitcoin ETF

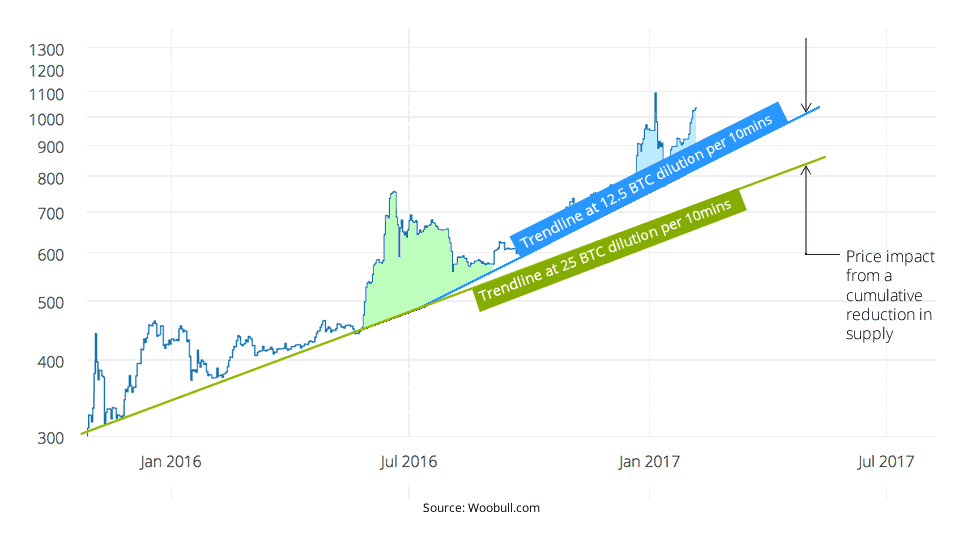

This infographic of Bitcoin’s price is something I’ve been pondering today. It tells Bitcoin’s often dramatic price story in fundamental trend lines on top of which lives some serious doses of speculative activity. There’s a lot in this chart so lets break it down.

- In late 2015 through to May 2016 we saw a three cats and a moon consolidation pattern play out over 6 months after an MMM pyramid scheme took Bitcoin price action through some exciting times.

- By early June 2016 we saw a speculative bubble (marked in green above) as the market speculated on the upcoming block reward halving event. This was to be the second halving event, slashing payout and therefore the supply of new bitcoins from 25BTC every 10 minutes to… well, exactly half to 12.5BTC.

- Leading up to this many people we afraid the miners would exit their protective hashing power, the block processing caught between network adjustments could slow to a crawl and the price could crash. This did not happen. What happened was simply the markets saw less selling pressure from miners who had less newly minted coins to sell. The blue trend shows the steeper rate of price appreciation this had on the markets.

- Finally what we may be seeing is the Q4 of 2016 to present is the market undergoing a much larger and longer speculative phase for the upcoming Bitcoin ETF decision. If approved hundreds of millions at a minimum are expected to be poured into Bitcoin. Understandably the blue shaded area in our infographic would map to the drawn out and much delayed ETF decision which will finalise on March 11th, 2017.

If this story is fundamentally correct, the picture it paints is quite useful. In fact, we can deduce the impact of what a controlled reduction of coin supply from the markets will have to the price, furthermore we can gauge the amount of capital that the markets expect to be injected.

Methodology

The diagram above, traces two price trajectories, they etch out the price impact of two monetary dilution policies. Every 10 minutes, blue supplies 12.5BTC onto the markets, while green supplies 25BTC. The difference between the two trend lines at any point in time will give you the “fair value” price impact from their differences in supply. I say “fair value” as in reality bubble mania would take hold and we’d see a party session above the new baseline and probably another very long 3 cats and a moon consolidation.

First a note about the accuracy of this method. As any chartist / trader can attest, placement of the trend lines is an art, so bear in mind the actual results are subject to not insignificant errors. Nevertheless let’s see if the results make any sense…

Block halving impact on price

| **Daily price appreciation** | **Annual price appreciation** | |

| **Before Block Halving** | 0.19% | 97% |

| **After Block Halving** | 0.29% | 188% |

Impact of ETF capital on Bitcoin price

| **ETF capital** | **Equivalent Block Halving Impact** | **% Price Impact**** | **USD Price Impact**** | **Fair Value Price** | **Fair Value Marketcap** |

| permanently unsuccessful | 0 days | 0% | $0 | $900 | $14.6b |

| $300m | 185 days | 21% | +$190 | $1,090 | $17.7b |

| $500m | 309 days | 38% | +$339 | $1,240 | $20.0b |

| $1b | 617 days | 90% | +$805 | $1,700 | $27.7b |

| $2.0b | 1235 days | 259% | +$2,331 | $3,200 | $52.4b |

Results and comments

-

Fundamental Price

The fundamental baseline price of Bitcoin, without any speculation on the day of the ETF decision came to $900. -

Fundamental ROI

Our trend lines indicate Bitcoin’s return on investment made a step change from 97%pa to 188%pa after the block halving event which saw monetary inflation reduce from 10% to 4%. -

ETF price impact and market capitalisations

Running through different capital injection scenarios, we have predictions of between $1090 for a $300m capital injection to $3200 for a $2b FOMO stampede. In comparative terms, Gold ETFs account for 0.6% of gold market cap while a single $300m ETF inflow would account for 2% of Bitcoin market cap. -

Current market speculation

Needham and Company published a report early this year estimating that an ETF approval was likely below 25%, however at the time of writing the newly released BitMex EFT prediction market is expecting a 33% chance. We’ve seen speculative bitcoin pricing in the range of $1050-$1150 and success probabilities of 25-33%, this is inline with a $500m-$1b capital injection from ETFs. In such a scenario we would see Bitcoin market cap swell to $20b-28b. -

What does this mean in terms of March 2017 price action?

When the results become known on March 11, 2017 the markets will respond sharply due to speculative pricing[1]. Let’s say the price of Bitcoin is $1090 leading up to the announcement. An approval decision could see an immediate $380-$570 price climb[2] for fair value valuation, conversely with a negative decision slash the $190 speculative premium towards the $900 baseline. How much would depend on sentiments towards yet another shot at ETF approval. -

Notes about this model

My model does not per se predict absolute price targets. Rather, it’s a garbage in, garbage out machine. Given speculative pricing before a decision and a probability of success estimate, it produces a target fair value price and ETF capital required to make this happen. It does not estimate the magnitude of a speculative bubble on top of the fair value fundamentals.

[1] The short term price would be speculators driven only. An actual ETF fund would source the majority of their bitcoins from over-the-counter markets to which would take some time before the impacts of reduced supply reached the Bitcoin exchange markets.

[2] At 25% chance price should calculate as $900+$1904 whereas at 33% probability the calculation would be $900+$1903

How does this compare to other reports?

-

Needham and Company

-- <25% chance of success

-- $300m capital inject in the first week

-- no price target

At 25% chance and a speculative pricing of $1100 pre-decision, my model would predict $1b of longer term capital injection and a fundamental valuation target of $1700. This is within ballpark. -

Seeking Alpha

-- 35% chance of success

-- price target $3678

-- probability adjusted price $1645

If probability adjusted price is in fact $1645, my model would predict a fair value price target of $3125 (and $2.2b of ETF capital). Given their target likely accounts for speculative overshoots that always plague price mania, the two are moderately in agreement. In this case the speculative overshoot would need to be 18%. Seeking Alpha comment the markets are undervaluing Bitcoin by a wild margin (67% at the time of the report).