The network effects of volatility and liquidity, Bitcoin vs other payment coins

2016 has been a bull year for privacy coins. Earlier this year we saw mooning of Monero which saw subsequent pumps in other dark-coins including ShadowCash and Navcoin. Then we witnessed a mega-hyped launch of ZCash which peaked at an astounding $5.3k per coin.

All of these coins are Payment Coins competing in the battle win the war to be General Money. Let me explain. While most altcoins tend to be forging into market specific app-coin territory, what makes payment coins unique is the shear size of the potential win, while app-coins can capture a market segment which effectively puts a cap on their valuation, payment coins being a kind of generalised money can capture “M2 money supply” as a ceiling, i.e. trillions.

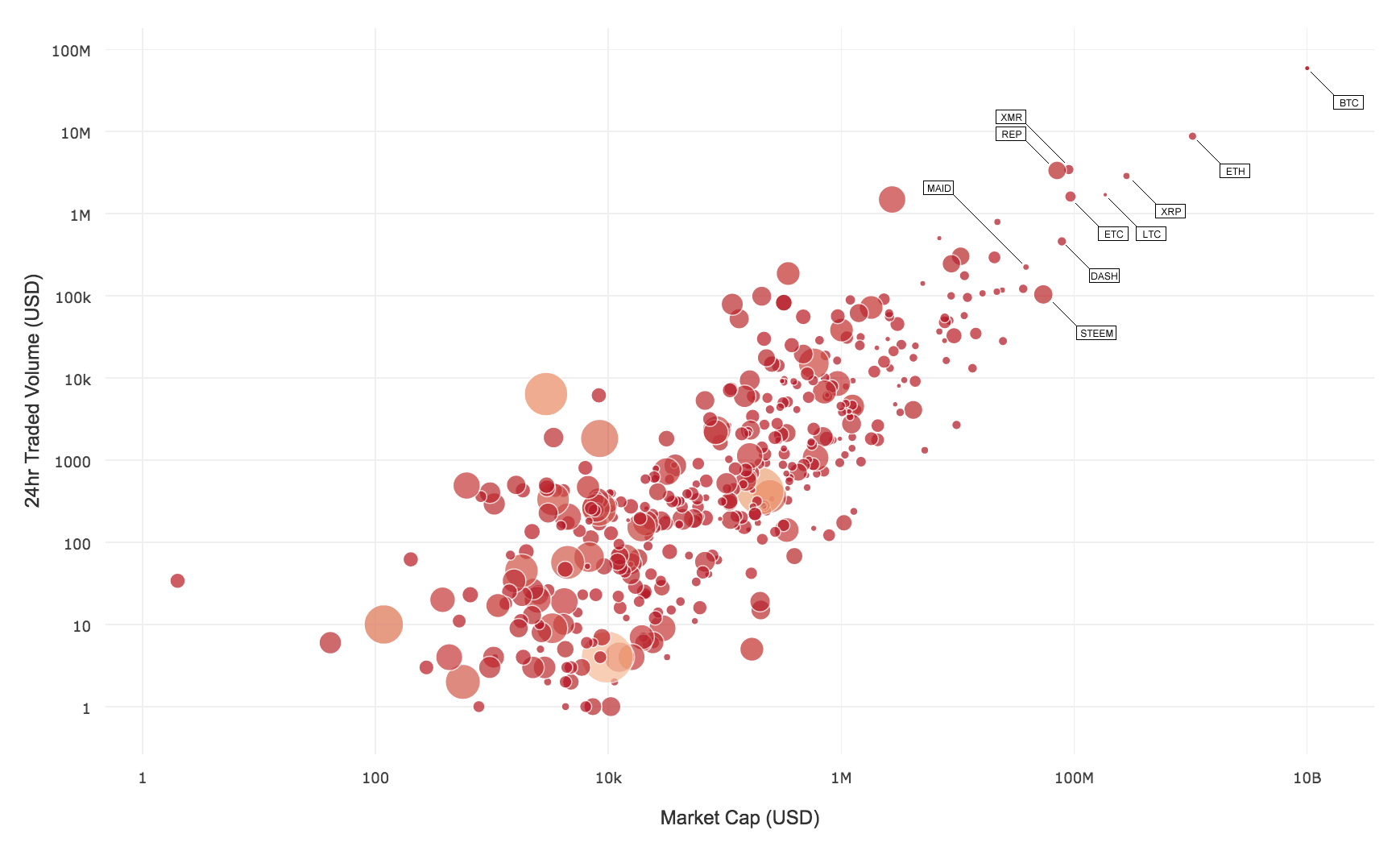

When I look at payment coins I see very strong economic network effects are in play. I covered earlier with my Commerce Index that liquidity and low volatility are very important for a coin to be useful for general trade. Both of these qualities are crucial to make it compelling for end consumers to charge their wallet with a payment token to spend. With high volatility there’s too much risk holding funds and with insufficient liquidity wallet recharge and merchant fees will be high.

When looking at the combined qualities of liquidity and price stability together as a Commerce Index, we could see other coins catching up with Bitcoin. In this study I will be doing a deeper dive into these two qualities individually.

For the sake of this study, I will be looking at the leading coins by market cap, namely Bitcoin, Monero, Dash, ZCash and ShadowCash. All of these coins are well above $5m market cap, NavCoin and others at less than $3m have been excluded.

Liquidity of Payment Coins

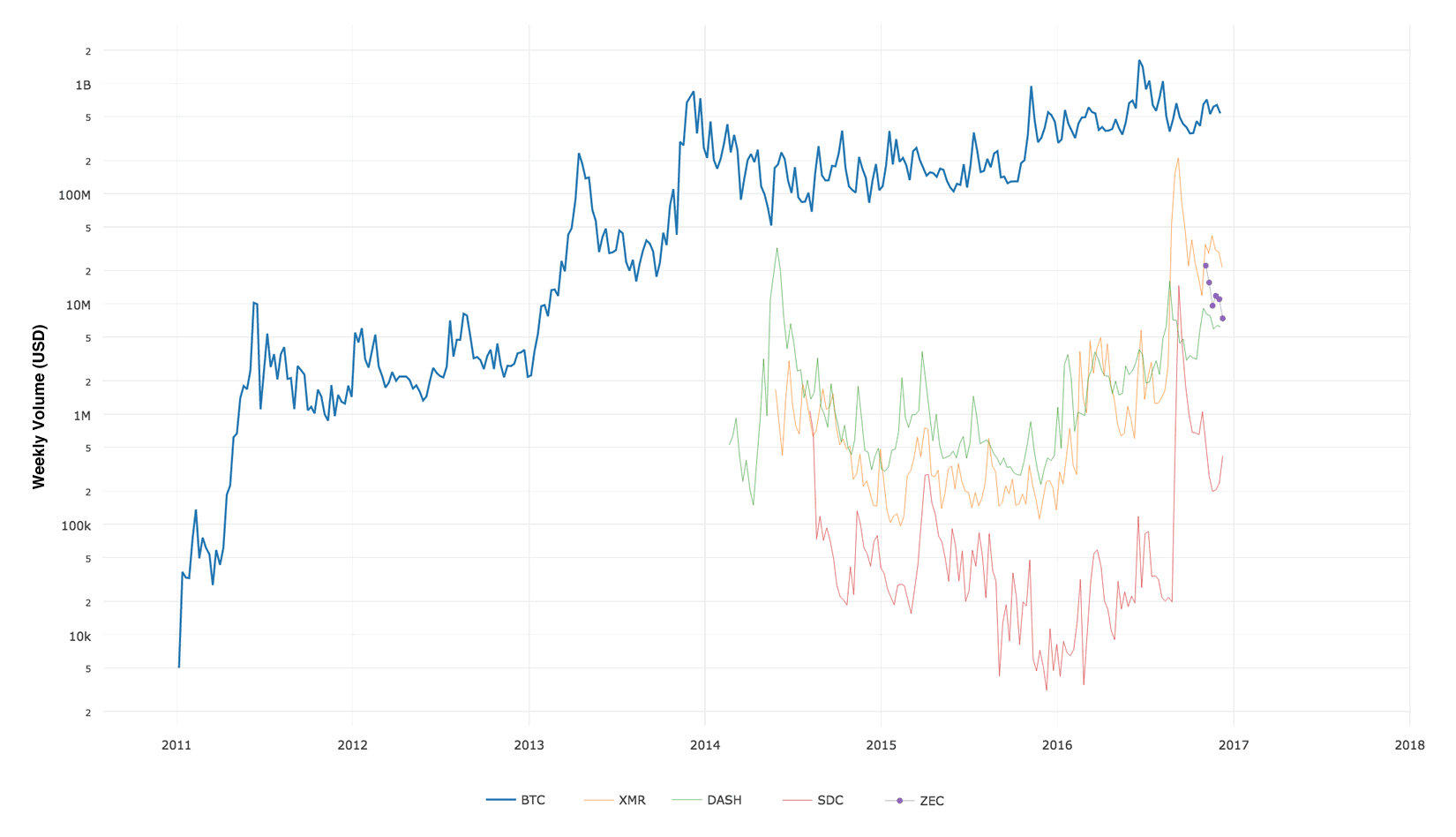

The plot above shows the liquidity (weekly traded volume) of each payment coin. For the sake of comparing apples with apples the Chinese zero fee markets for Bitcoin have been ignored as volumes can be faked easily. If we had included them you can multiply Bitcoin’s volumes by 10-100x.

The liquidity of alt-payment-coins have been on a rapid rise in 2016, particularly in the case of Monero which if this year’s trend continues could match Bitcoin in just one year. There’s an argument here that liquidity can climb quickly upon the introduction of a new currency as can be seen by the steep liquidity growth of Bitcoin in its first two years.

Of note is ZCash’s introduction which opened with remarkable liquidity, levels similar to what Monero and Dash enjoy today but took them 2-3 years to achieve. It’s pretty clear that liquidity can be won very quickly.

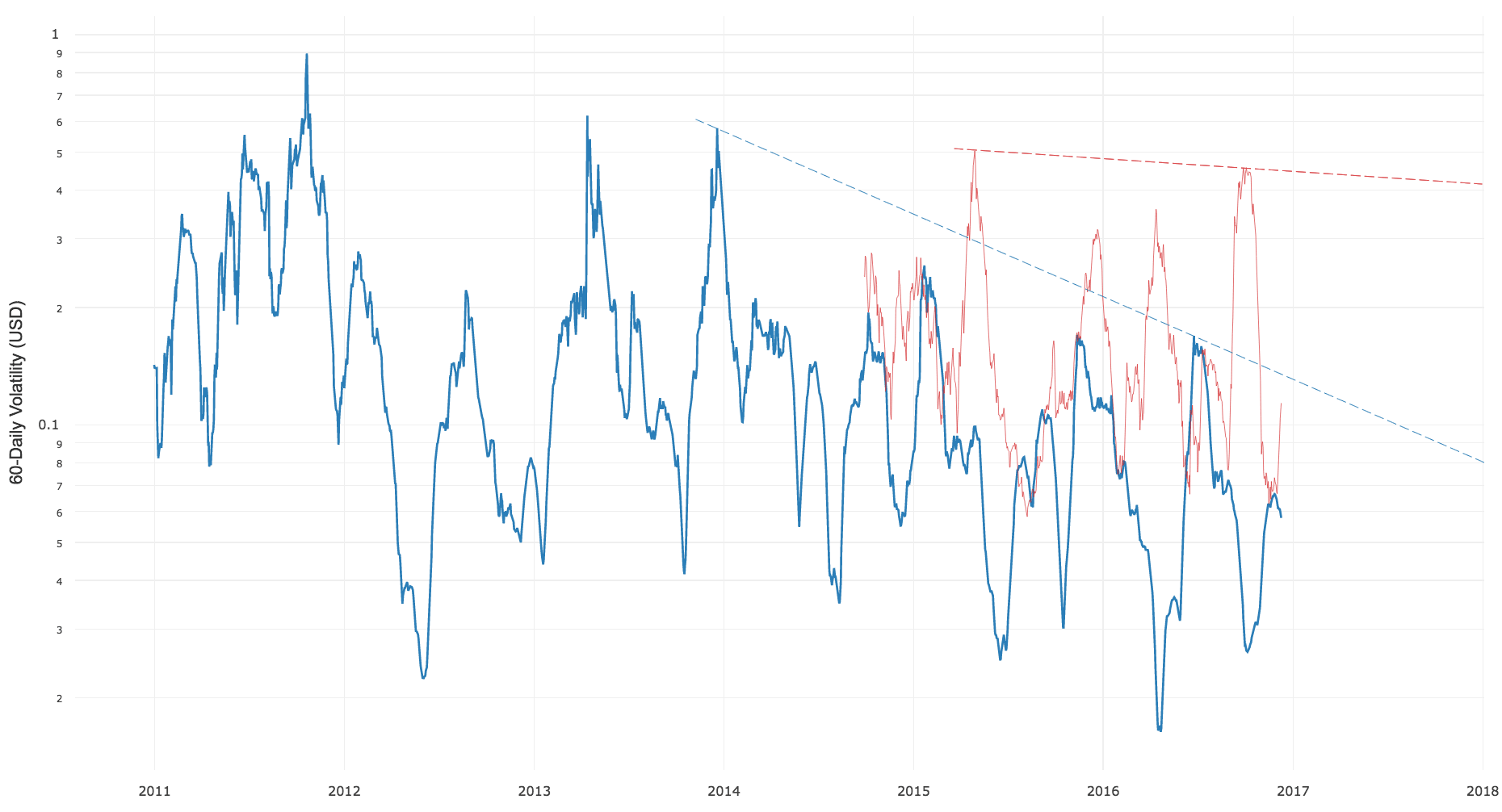

Volatility of Payment Coins

Arguably achieving low volatility is more important than sheer liquidity as this is key to mass adoption. Consumers need to be sure the payment currency is stable before charging their wallets. If the token price swings wildly like we saw in the Bitcoin early days, we would see very few people holding it in their wallets, and no chance for user adoption. It’s the prerequisite – if nobody is using your coin because of high volatility then who cares if you have liquidity to assist in lowering merchant fees.

In this section I’ll plot each payment coin’s volatility trend.

Bitcoin Volatility

In a previous volatility study I established that Bitcoin is well on the path to being the most stable currency in the world, an astounding claim, one that surprised me.

Yet when I break down the mechanism in which price stability is achieved, it makes sense. Price stability happens at the exchanges. If you want to buy or sell a currency and there’s millions of buyers or sellers on the other side of the market wanting to take your order, you will see a very small change in price movement from your trade. When we look at fiat FOREX markets, the orders comprise of speculative trade, international trade and remittances. National trade within a currency never hits the FOREX exchanges. But with Bitcoin nearly all merchant and remittance activity worldwide hits the exchanges to convert to fiat, thus the potential for a much deeper orderbook. Another way to say this that with Bitcoin, every cup of coffee you buy, anywhere in the world adds to market stability. Its ceiling on stability should be orders of magnitude more stable than fiat currencies.

The study concluded Bitcoin would achieve fiat level volatility by mid-2019, which in my opinion is a level that will create a positive feedback loop for Bitcoin as the mainstream population will feel comfortable holding funds in bitcoin. This should open the way for Bitcoin as a viable mainstream currency for the use of day to day commerce, further increasing its stability. A side conclusion was that payment startups such as BitPay are too early, their time will come in 2-3 years.

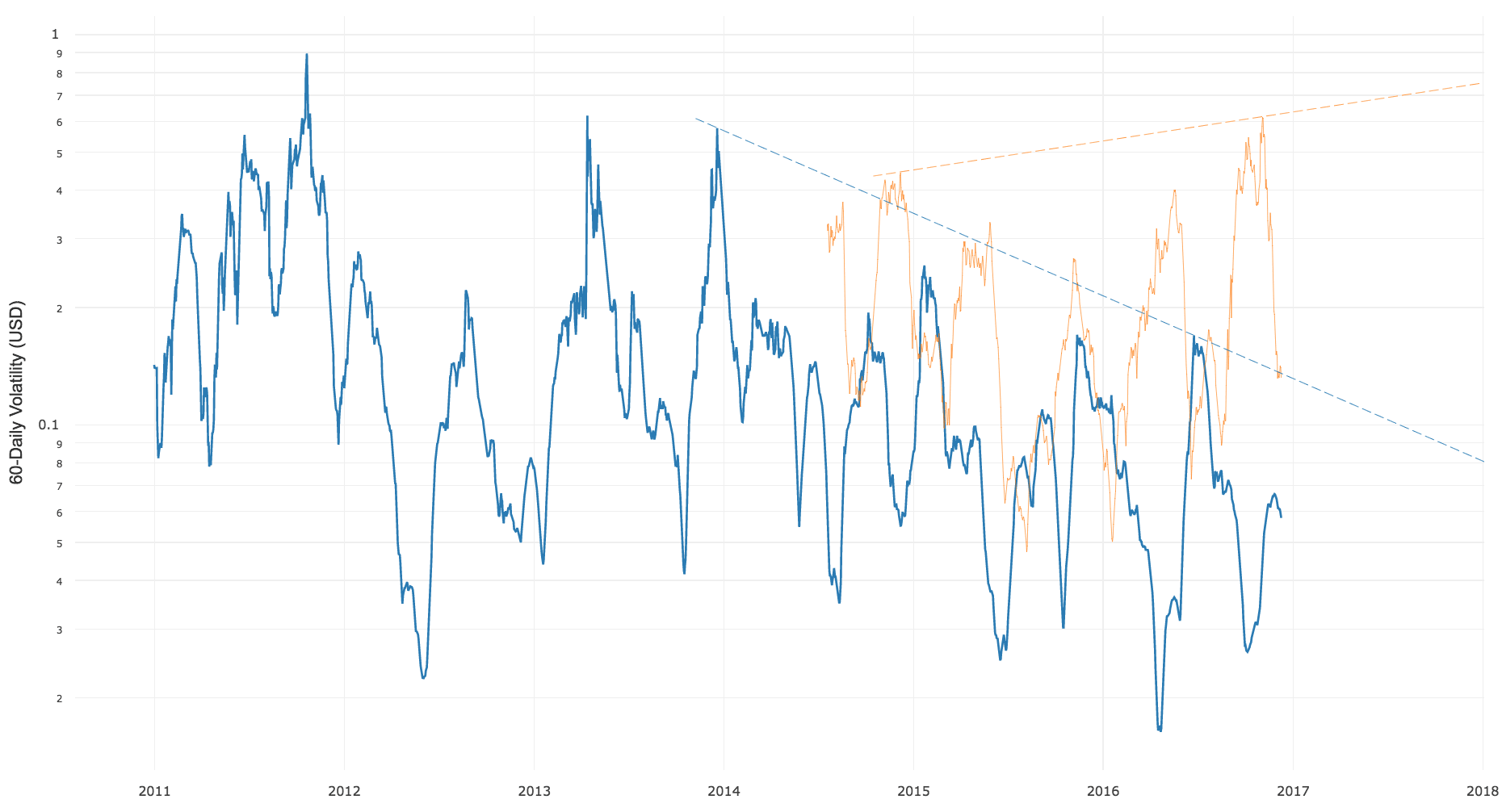

Monero Volatility

First up in our alt-payment-coin list is Monero, the biggest payment coin behind Bitcoin. Unfortunately Monero over its 2.5 year history has shown an increasing trend in volatility. We’ve seen a lot more speculators pushing the price around during its 2016 price breakouts. Here we see how keeping liquidity high and volatility low can be like pulling on opposite ends of a tug-o-war. Often high volatility attracts traders which then feeds an increase in liquidity.

Though Monero may be losing out on reduced volatility, it has a very important feature. Unlike Dash, ZCash and ShadowCash it is unique in that it is not a fork of Bitcoin, so it has a chance of winning the payment coin war by competitor implosion should there be a vulnerability in Bitcoin’s codebase. Monero is an excellent Bitcoin hedge in my opinion.

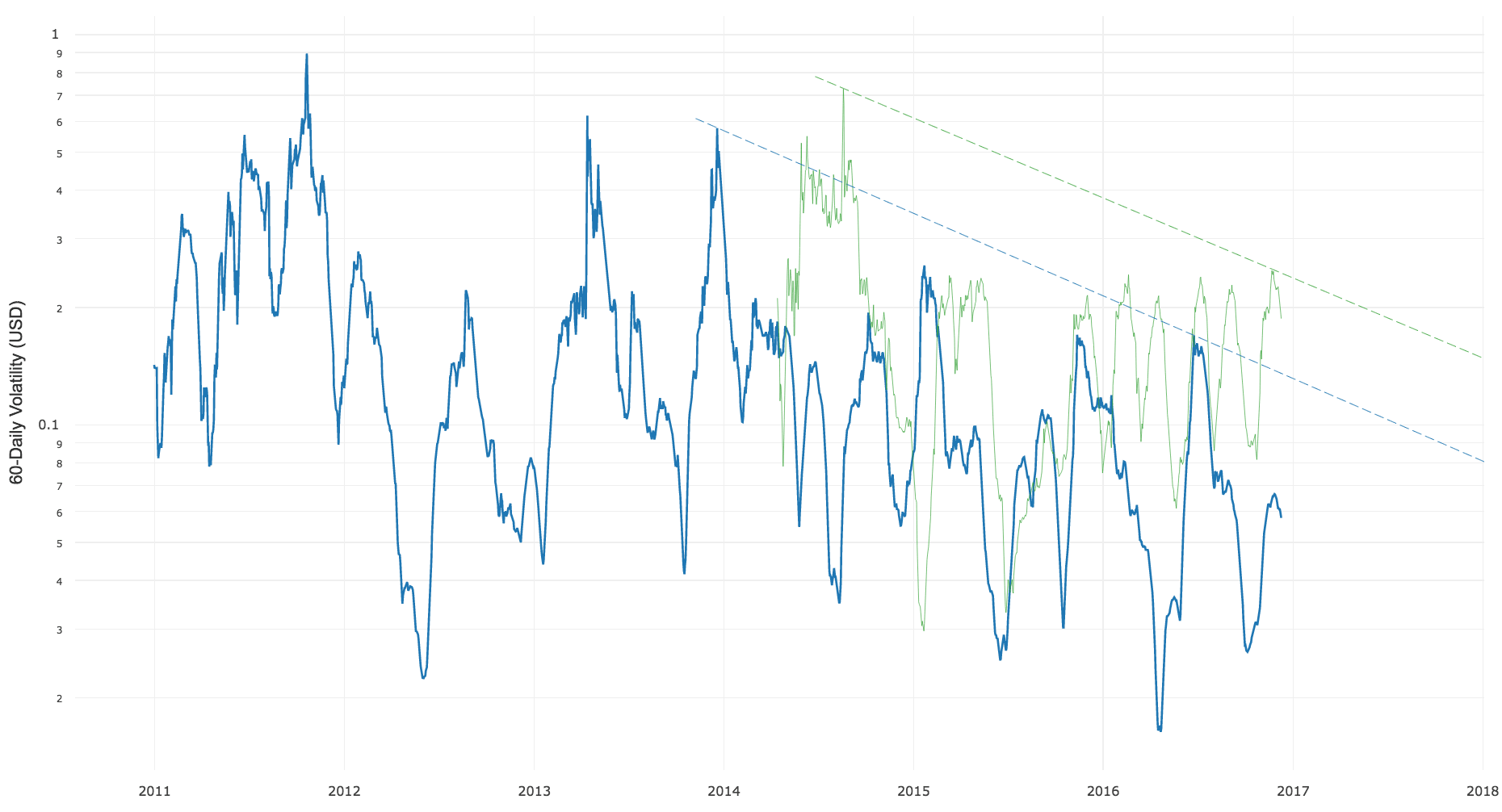

Dash Volatility

Dash was pleasantly surprising, showing a volatility reduction inline with Bitcoin, while its liquidity is climbing at a rate, if sustained, to catch Bitcoin in 1-2 years. In terms of lag, Dash is about 18 months behind in Bitcoin in volatility but unlikely to catch up if its present trend continues.

Last time I checked, 65% of DASH is locked up in MasterNode staking which creates a flow of currency to MasterNode owners, also 10% of block rewards are spent to develop the network. This flow of currency could be responsible for Dash’s lower volatility. The theory being that currency flowing to more people should add more depth and more even distribution to the orderbooks of Dash and it’s these two properties that ultimately reduces volatility.

ZCash Volatility

ZCash is the new kid on the block, at barely 6 weeks old, it’s not had enough time in the market to even calculate a single 60-day volatility point on a chart. I ran a check of 30-day volatility, and it varied between 90% and 9500%. That’s literally off the charts and we’ll need wait some time before we see any meaningful trends.

ShadowCash Volatility

ShadowCash like Dash is making inroads with liquidity, with just over 2 years to match Bitcoin liquidity if 2016 trends can be sustained. From our two years of history on this coin, we can see a slight reduction in volatility, but not at any rate that will catch up with Bitcoin. Like Dash, this coin allows staking with a 3-4% return for holders compared to Dash’s 10-11% returns. This could be the reason for SDC’s proportionally smaller decline in volatility compared to Dash.

Conclusions

I started this study to double check my assumptions that Bitcoin was well ahead of the pack in network effects. What the data showed was this was only partly true.

- Bitcoin’s lead in liquidity is not unassailable, Monero could match it in a year, Dash and ShadowCash in just over two. This ignores zero fee markets of Bitcoin which are colossal so perhaps it’s not a fair comparison. Probably the most accurate comparison would be to look at on-chain transaction volume which is difficult data to get, involving estimates of transaction values (technically, an estimate of change outputs back to the sender).

- Low volatility is much harder to achieve and Bitcoin has a solid lead in this regard. No other payment coin is on track to catch Bitcoin, but Dash had a strong showing with similar reductions but a lagging Bitcoin by 18 months but no signs of catching it.

- Interestingly, Dash and ShadowCash’s staking mechanisms which distribute payouts to more participants than just miners, seem be making a significant difference in reducing volatility. This is in no way conclusive, but in theory it makes sense.

All of Bitcoin’s competitors tote features that Bitcoin is lacking – faster confirmation times and private payments. Both of these features will most likely be coming to Bitcoin as layer 2 protocols in 2017. If and when this happens, the battle for payments and general money will be fought solely on the playing field of economic network effects, that of liquidity and volatility. Bitcoin remains the standout contender in this regard.