Data visualisation: 118 coins plotted over time this is why HODL altcoin indexes don't work

Do you like my canvas art? I’m calling it “shit runs downhill“. I’m thinking about mounting it on my wall to remind me of the perils of HODLing altcoins. After finding out that altcoin index funds don’t really work, I put together a data visualisation of altcoin price performance as further research into why.

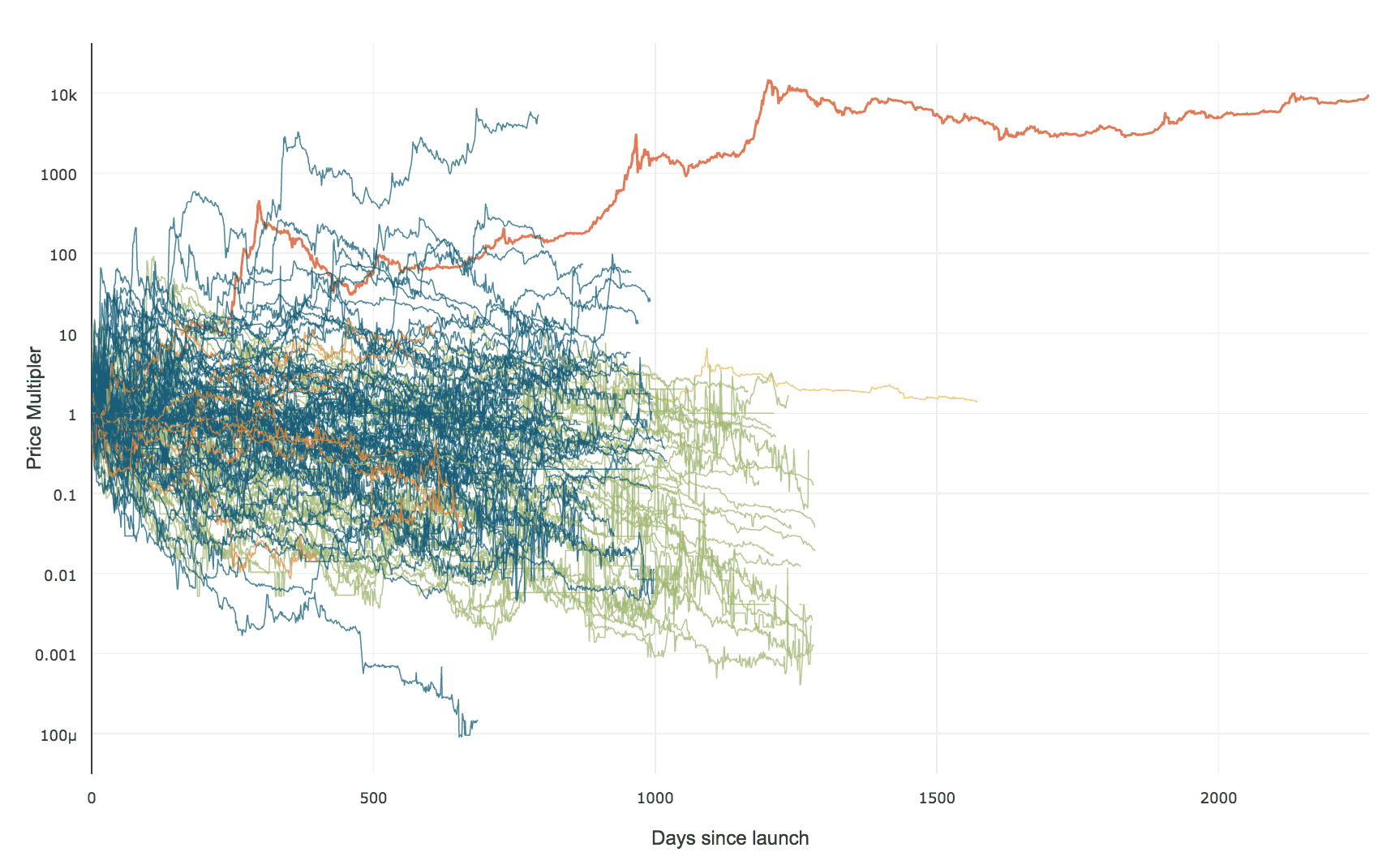

Here’s a plot of all altcoins that have been floated onto the markets that have achieved at least an average of $250,000 market cap in any one year of their existence. I’ve plotted them at the starting lines from the first day of their market float to see how they performed against each other. The tally came to 118 altcoins. Here’s my plot below.

Can you see why it’s really hard to beat bitcoin now? That red line is bitcoin, by the way.

All my friends are asking if that wiggle above bitcoin is Ethereum. Sorry no, it’s GAME, I don’t know what that is, but it’s likely a statistical aberration – someone’s gotta get lucky. I mean when I look sideways, it’s like a rocket engine, some of the exhaust flames go to the edges, it’s just thermodynamics.

Zooming in by year

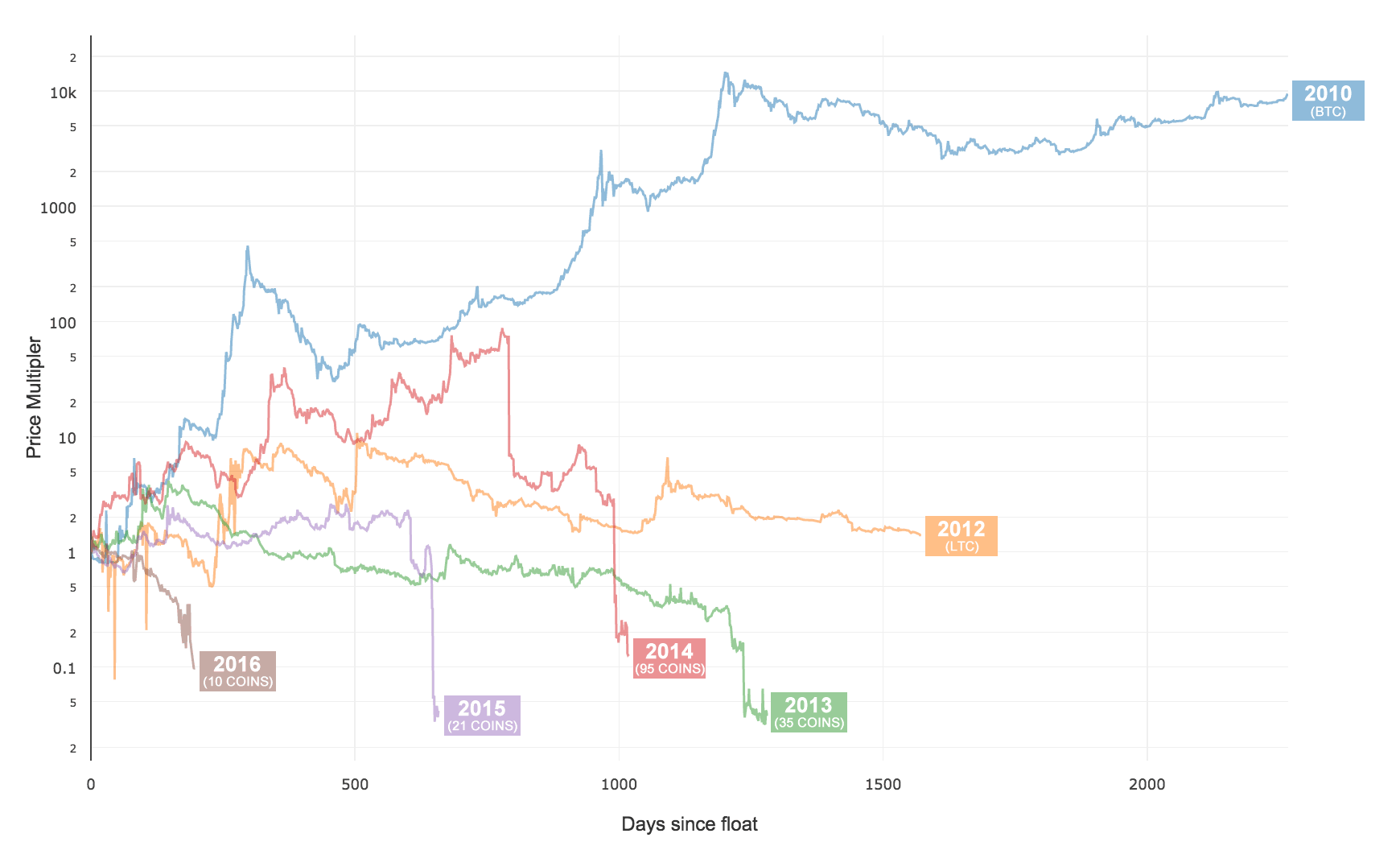

Breaking this down to make more sense of it, I’ve grouped them by year of initial float onto the exchanges and as an average per group we see this plot below:

If anything, average altcoin performance is getting worse over time, though this is probably due to a lot of scams coming into the marketplace. Quite clearly 2014 with 95 coins on offer was the year of the ICOs.

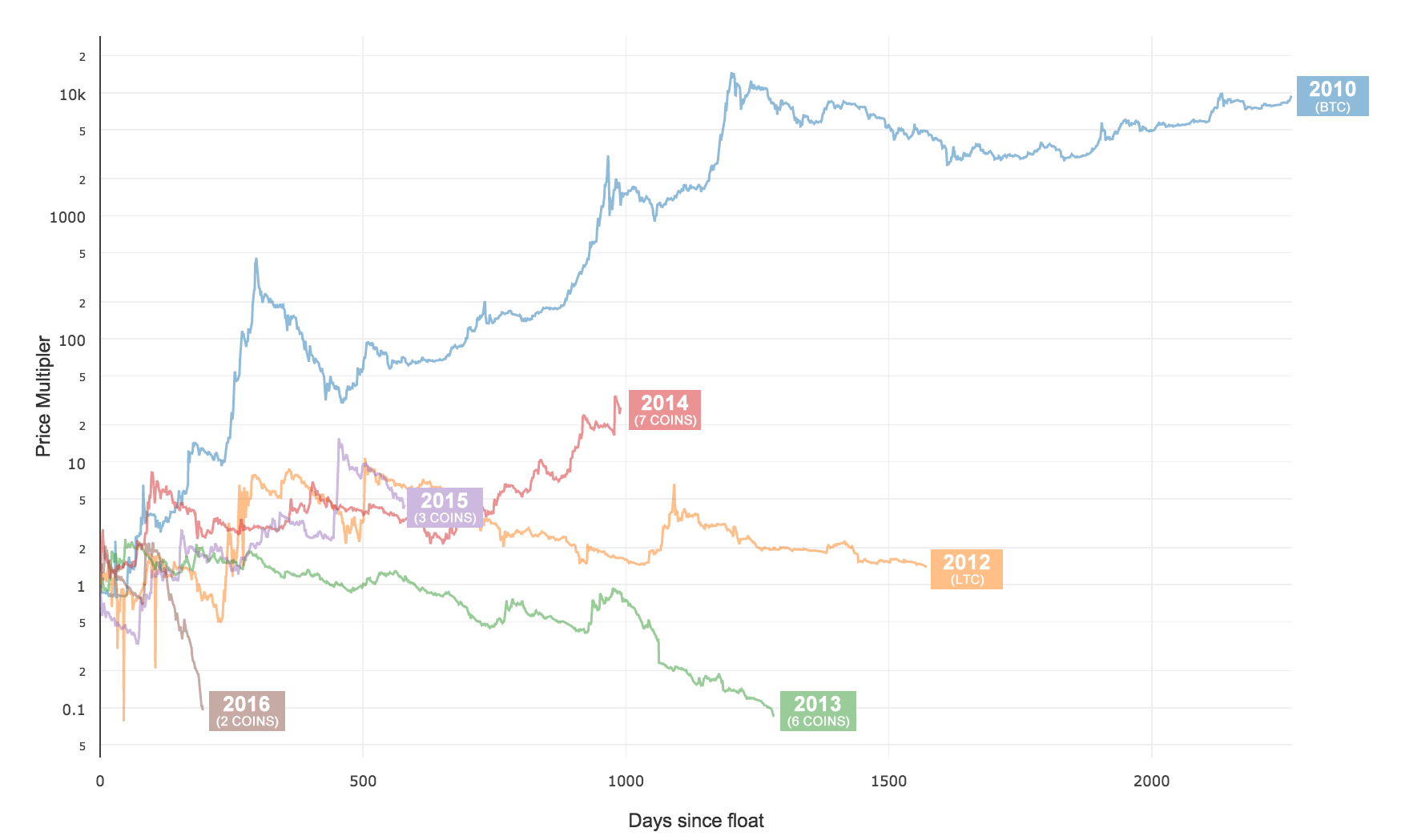

Now $250,000 market cap is a really small figure to achieve for a coin so we might want to filter these coins to the big leagues. The plot below sets the bar at $10m market cap and the picture improves somewhat:

Conclusions

I was hoping to see a trend towards better performance as new altcoins start to forge new and legitimate marketshare beyond the vertical that bitcoin has chosen. There’s no clear picture here beyond bitcoin outperforming altcoins from every year. While 2014 and 2015 did better than 2013 and 2012, 2016 looks abysmal.

Even applying a $10m market cap filter which should bring us beyond scam-coins, to coin platforms that should promise higher returns from their new and untouched markets, these guys (well below 10 coins introduced per year) continue to be outperformed by bitcoin.

It seems that altcoins are best left for trading due to their volatility, but very risky as holds. This may change in the years ahead, but for now, out of 700+ coins in my database I would say less than 5 have a shot of doing something interesting. It reminds me of early stage startup investing actually.