An economic comparison of payment coins, who is winning the race?

Last week I created the Commerce Index as a means to measure a coin’s suitability for general commerce. In a nutshell it tracks the property of liquidity and low volatility.

Both consumers and merchants want a currency that is stable and has high enough liquidity at the exchanges such that converting into and out of that coin does not incur high fees.

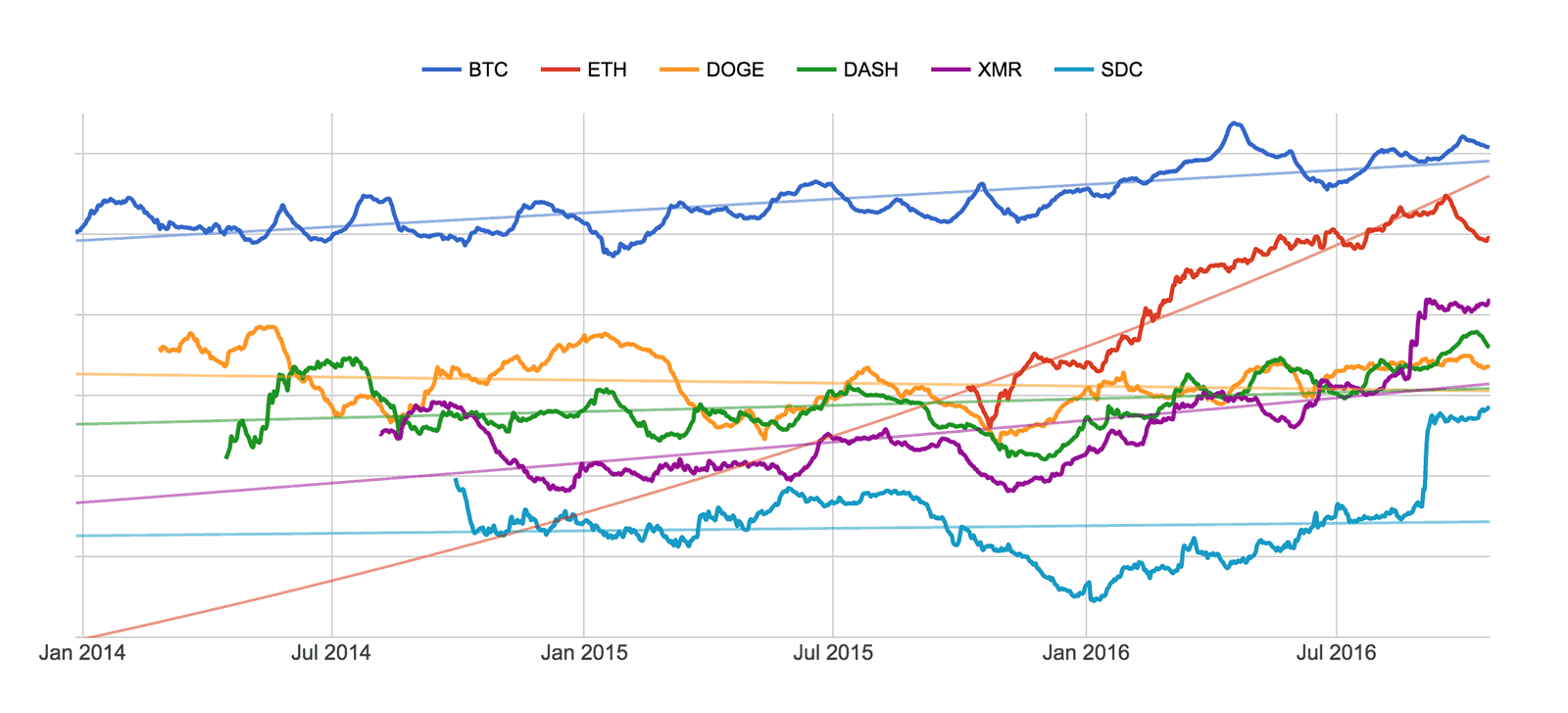

This graph compares the Commerce Index of some more notable coins that are aiming for use in payments.

Here’s a quick summary:

- Bitcoin unsurprisingly wins out with its huge head start, high traded volumes, and the lowest volatility of any crypto-currency. It’s making steady progress.

- Ethereum was the big surprise, I had no idea it would grow so fast in suitability for general commerce. Ironically it was never intended for general commerce, but that’s probably why it’s progressing the quickest, more on this later.

- Monero, the privacy coin with a bent toward the dark markets comes a very recent third, aided by its huge price pump of the last couple of months. The dark markets announcing acceptance of the coin spurred a speculator frenzy resulting in a 8x price increase and healthy bumps in liquidity.

- Dash, the digital cash token with a blockchain governance and budget system has been a long time front runner now comes in fourth, pipped by Monero just recently.

- Dogecoin, the token for tipping and good humour has been in a slow and steady long term decline.

- ShadowCash is a relatively unknown privacy coin based on the ring signatures (like Monero) but using a fork of the Bitcoin source code. It was in decline for commerce properties until 2016 where it turned around with the announcement of its marketplace offering. The halo effect from Monero’s big price pump, gave it a boost, as all privacy coins have suddenly been trendy.

Conclusions

Our two front runners, are Bitcoin and Ethereum. Size and network effects are at play. This is the name of the game to achieve the economic properties needed.

Meanwhile the others aren’t catching up.

Payment coins take the features based approach. Sure they have great whizz-bang features like instant payments and fungibility, but these are just features and they can and are being added onto Bitcoin and Ethereum as layer-2 protocols as we speak.

The really hard work is gaining adoption. Consumers will not hold your coin to spend if it is volatile, merchants will not take your coin if there’s no consumers, and you coin will continue to be volatile unless there’s people in large numbers holding and using it. What you have is a chicken and egg problem.

Break the catch-22 you need a new reason for people to buy into your coin, and that’s where Ethereum gets it right. Ether is needed as fuel to run apps on its network, this fuels speculator demand and adoption.

So the irony is currencies not designed for payments may make they best payment coins. Kinda reminds me of my trip to Vanuatu. In the outer islands, far from modern developments and tourist traps, I saw lots of woven matts, I was told these were used as payment tokens.